The age old argument; to buy or to rent.

Like any financial decision, there are costs and benefits associated with buying or renting. Here we discuss some of the important pros and cons to consider when deciding whether to rent or buy.

Buying:

Pros:

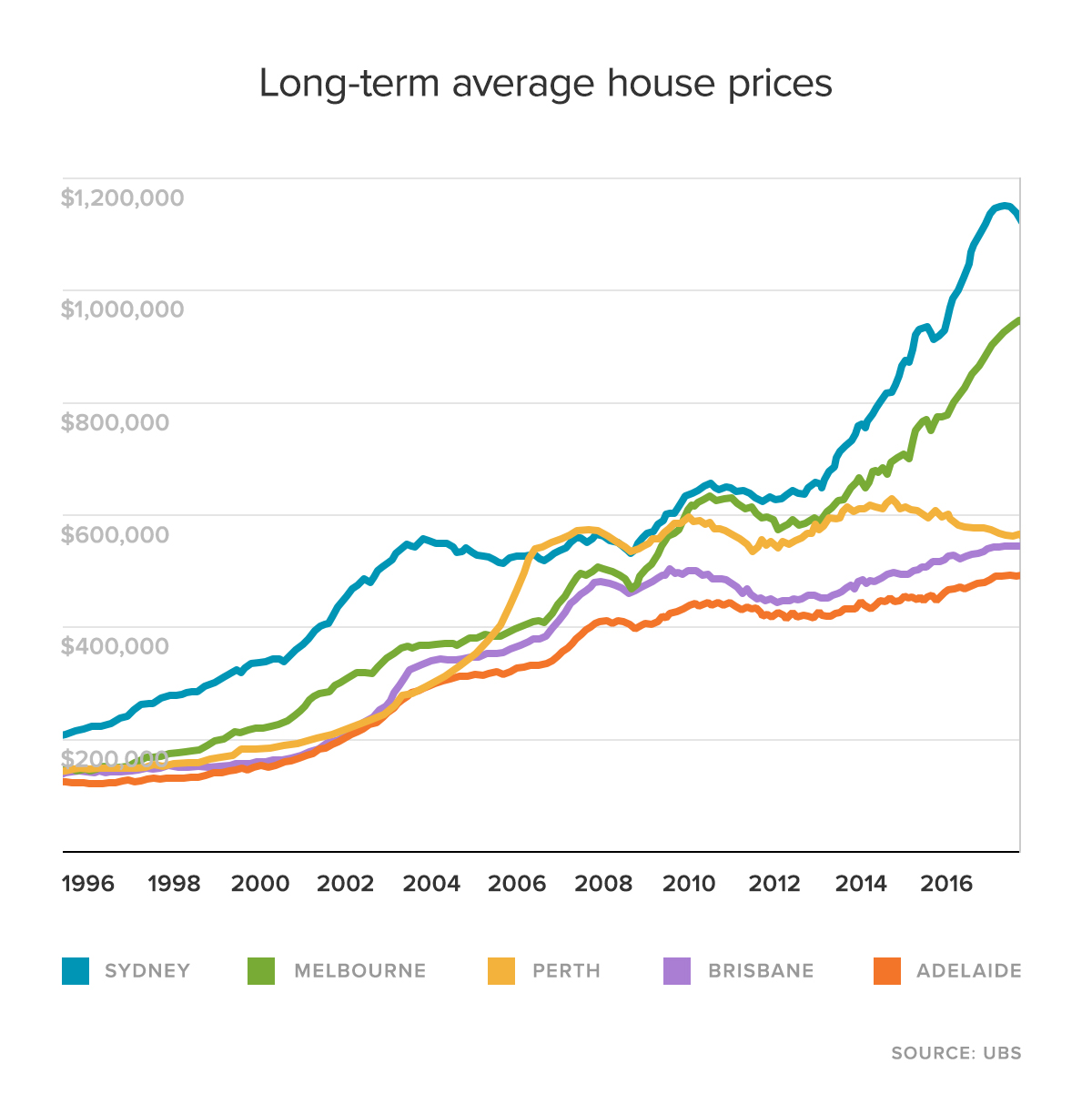

- The appreciation (rise) in house prices over time. Unless your head has been in the sand, chances are you’ve seen stories of house prices rising and falling over the past 5 years, all around Australia.

The median Sydney property rose more than 70% between 2013 and 2018 and other major cities like Melbourne and Brisbane have seen steady gains. There are also good tax benefits for owning your own home over the long run because you don’t pay tax on capital gains on your primary place of residence.

The median Sydney property rose more than 70% between 2013 and 2018 and other major cities like Melbourne and Brisbane have seen steady gains. There are also good tax benefits for owning your own home over the long run because you don’t pay tax on capital gains on your primary place of residence.

But while house prices have consistently risen over the long-term, they can also have periods of weak growth or even fall in value. During the financial crisis, house prices in the US fell by an average of 33.8%. There’s little tax benefit of owning your home if prices fall.

House owners also need to understand and be prepared to cope during periods of house price weakness.

2) Buying also provides some intangible benefits, like the security of not being displaced when the landlord decides to kick you out, and the flexibility to renovate the property [Making something your own is priceless].

Cons:

1) Interest repayments, the average variable interest rate is currently about 3.99%, which means that you would pay about $30,000 of interest each year on a $800,000 loan. That’s almost the same amount as the $27,000 you would pay to rent a similar value property for a year. That’s not much less than half the average after-tax salary in Australia which means for many people, most of their income could be gone in interest. With interest rates at all time lows there’s a good chance that the interest rates in 5 or 10 years time will be much higher than now which means mortgage repayments could increase in the future.

2) Ownership costs. The costs of buying and selling a property are high. The RBA estimates that the costs of buying a house including stamp duty and other buying costs including conveyancing can be 4.3% on average. The cost of selling a house including real estate agent commissions and advertising costs add up to about 3.0%. Therefore the total costs of buying and selling a house are in the vicinity of 7.3%. And this ignores the ongoing running costs of owning a property which the RBA estimates to be at least 2.6% per year including council rates, repairs, depreciation, body corporate fees, water and insurance costs.

Renting

Pros

1) Return on your savings. The argument is, that renting can free up your savings to earn a return elsewhere and depending on where those savings are invested, they may be able to earn a higher return than would be possible in property with the money that’s been freed up. Returns available in term deposits and savings accounts have been falling recently as the RBA has cut interest rates. This has made other investments like shares and bonds more attractive since bank deposit rates are now under 2% compared to a balanced portfolio of shares and bonds which has historically returned closer to 8% over the long-term. However, the issue with this argument is that for a $500pw rental, it would equate to roughly a $700pw mortgage, you’re only saving $200pw to not own your own home, but to pay someone else’s mortgage instead.

2) Flexibility. While owning a property provides more stability, renting gives more flexibility. This may be attractive especially for young Australians and families who may need to move from place to place due to work, or schools.

Cons

1) Rental costs. Rent is the equivalent to interest you pay on a mortgage. It’s the cost of borrowing an asset – in the case of renting, the asset is a property whereas for a mortgage you’re borrowing money. While renting may seem expensive, rental yields actually reached a 12 year low in 2018. A typical total rental yield (annual rent costs / house value) for a house in Sydney or Melbourne is now 2.7% but ranges from 2.0% to 5.0% depending on factors such as location, property value and whether it’s an apartment or house.

2) No forced savings. Unlike buying [where you are forced to contribute to a mortgage each month, including interest and principal repayments], renting doesn’t encourage forced savings. This can make it tempting for renters to spend spare cash rather than setting it aside, which is what most renters end up doing.

In conclusion

Overall, i truly think you should assess the better option for you on a case by case basis. Your life priorities will change constantly, so you need to make the best choice for whatever point you are in life. If you don’t really know what the best choice is for you, feel free to give us a call to talk about your options.

Comments are closed.